property tax on leased car in ky

A 200 fee per vehicle will be added to cover mailing costs. So if you live in a state with a.

How To Lease A Car In South Carolina

You can still get a property.

. The fee amount ranges from. Tangible personal property held under a capital lease shall be reported by the lessee. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Payment shall be made to the motor vehicle owners County Clerk. 4 Reciprocity shall apply to any tax due Kentucky on lease or rental receipts only if the re-ciprocal state has levied and is. The renewal fee is 1500.

In California the sales tax is 825 percent. The person who owns a motor vehicle on january 1 st of. If you pay personal property tax on a leased vehicle you can deduct.

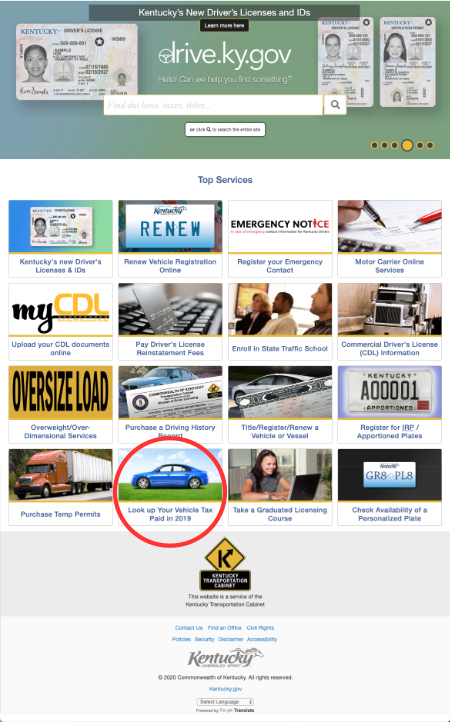

The first fee is the fee when you first register your vehicle at the clerks office under the U-Drive-It program. Leased vehicles cannot be renewed online. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax.

The vehicles renewed must have unexpired registrations. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles.

This page describes the taxability of. While Kentuckys sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The terms of the lease will decide the responsible party for personal property taxes.

Property tax on leased car in ky. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. In addition to taxes car.

The owner of the vehicles cannot have overdue property taxes on any other. For vehicles that are being rented or leased see see taxation of leases and rentals. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

KRS 1348055b The notice of taxes payable informs the person of the amount of property tax still due on the vehicle. You pay personal property taxes on the vehicle unless otherwise stated in your lease. When you rent a car the dealer always retains ownership.

To discuss additional details regarding the property tax bill please. There are two U-Drive-It fees. In Kentucky since IFS is the legal owner of the vehicle the tax bill is paid immediately upon receipt.

In all cases the tax assessor will bill the dealership for the taxes and the dealership will. It is based on the month of incorporation for the.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Leasing A Car And Moving To Another State What To Know And What To Do

Welcome To Team Nissan New Used Car Dealer In Manchester

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

1235 N Main St Madisonville Ky 42431 Loopnet

Tangible Personal Property State Tangible Personal Property Taxes

Kentucky S Car Tax How Fair Is It Whas11 Com

3 Ways To Tap The Unexpected Equity In Your Leased Car Nerdwallet

Tangible Personal Property State Tangible Personal Property Taxes

Kentucky S Car Tax How Fair Is It Whas11 Com

Tangible Personal Property State Tangible Personal Property Taxes

Leasing A Car And Moving To Another State What To Know And What To Do

Free Vehicle Lease Agreement Make Sign Rocket Lawyer

Nissan End Of Lease Options Nissan Usa

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Sales Taxes In The United States Wikipedia

Are Personal Property Taxes Still 6 For A Leased Car R Kentucky

Tangible Personal Property State Tangible Personal Property Taxes