reit dividend tax malaysia

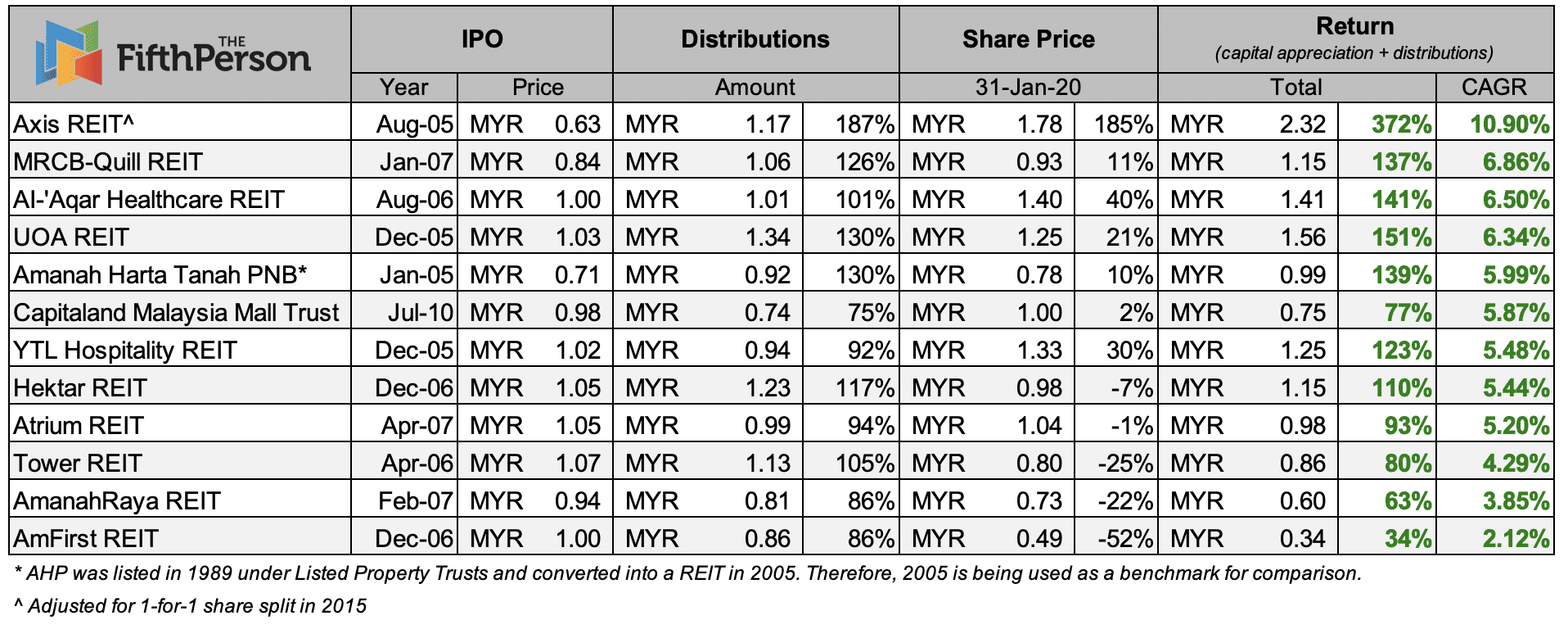

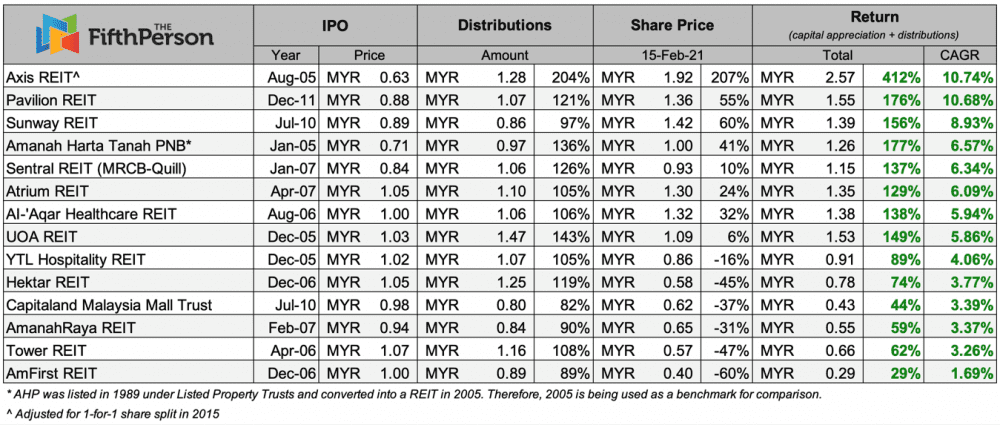

I would not buy this 5 reits now because the Dividend Yield DY are the lowest as well from 469 to 524 before deducting. Axis REIT Annualised return.

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Malaysian REIT Data LIVE Daily Updates.

. Most of the time the rate is determined by. IGB Commercial REIT was listed in September 2021 while Sunway REITs latest financial year consisted of an 18-month period. 1074 Since 2005 every RM1000 investment in Axis REIT wouldve turned into RM2980.

Real estate investment trusts REITs are a unique form of investment designed to make money for you through the property industry. Our Expert Investment Professionals Focus to Maximize Returns and Strive to Manage Risk. Ad Invest in Morningstar 4 and 5 Star Rated Funds.

As mentioned earlier a REIT company in Malaysia has to distribute at least 90 of its yearly income to enjoy tax exemption. 19 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link. Dividend income forms part.

Call us 603 7729 7018 l Email. There is no capital gains tax regime in Malaysia for the sale of. Governments announcement of remissions of dividend tax for the REIT sector under the 2007 2009 and 2011 budgets provide an excellent but rare opportunity to examine the impact of.

Taxation of dividend income distributed by REIT in the hand of investors. Real Estate Investment Trusts. As a comparison neighbouring.

AL-AQAR HEALTHCARE REIT Last Price. 122 TTM Dividend Yield. Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders.

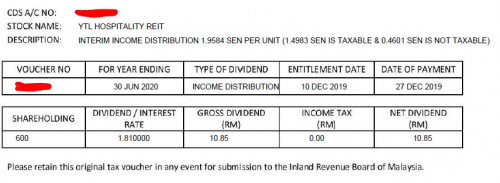

Including the dividends every RM1000 would. AMFIRST REAL ESTATE INVESTMENT TRUST. Withholding tax of 10 or 25.

If this 90 condition is not met the REIT would be subject to tax at the prevailing corporate income tax rate of 24. A REIT in Malaysia operates by pooling the. Simply put the rental income received by the.

Yahoo Google Bursa Web TradingView. Trusts or Property Trusts REITPTF in Malaysia. Since it was first introduced in Malaysia in 1989 REITs have allowed small-time investors to acquire and own a small portion of an otherwise expensive piece of real estate.

Ad Invest in Morningstar 4 and 5 Star Rated Funds. You invest in stocks. Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel.

Taxation and tax exemption of REITs in Malaysia. Our Expert Investment Professionals Focus to Maximize Returns and Strive to Manage Risk. 603-7785 2624 603-7785 2625.

639 Coming Quarter Report. Prior to the announcement under the tax laws a property trust fund essentially an unit trust with income. If you invest in stocks your dividend withholding tax rate is determined by your country of residence.

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

M Reits Still Favoured Despite Expected Lower Rents The Edge Markets

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Dividends Archives Page 6 Of 7 Dividend Magic

What Are The Cons Of Investing In Reits In Malaysia

Finance Malaysia Blogspot Understanding Reits

Association Seeks Tax Free Dividends For Reits The Edge Markets

Pdf Jurnal Teknologi A Review On Malaysia And Singapore Islamic Reits Regulatory Structure

Formula For Computation Of Reit Formula For Computation Of Total Income For Reit 1 Start With Net Studocu

Axis Reit Archives Dividend Magic

Axis Reit Archives Dividend Magic

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

How Are Individual Reit Holders Taxed Thannees Articles