corporate tax increase effects

The option would increase revenues by 96 billion from. The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35.

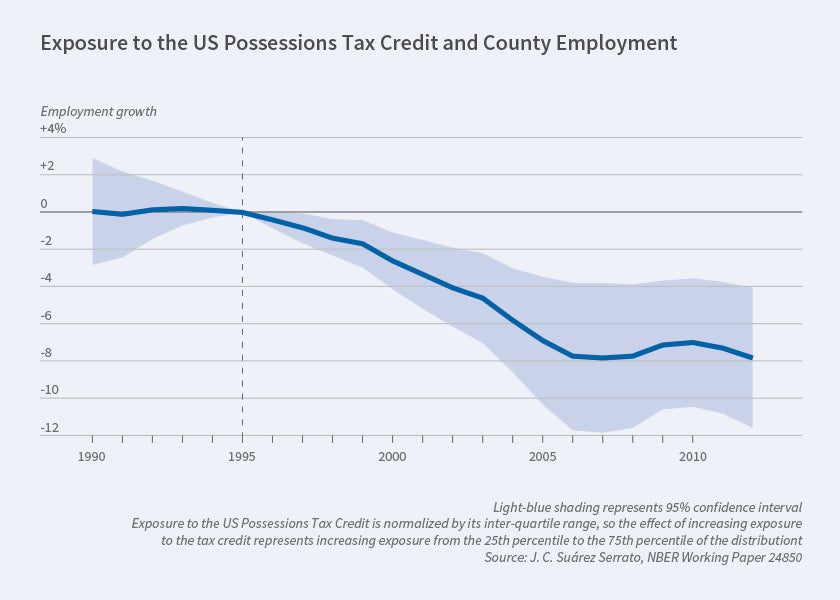

Economic Effects Of Repealing The Us Possessions Corporation Tax Credit Nber

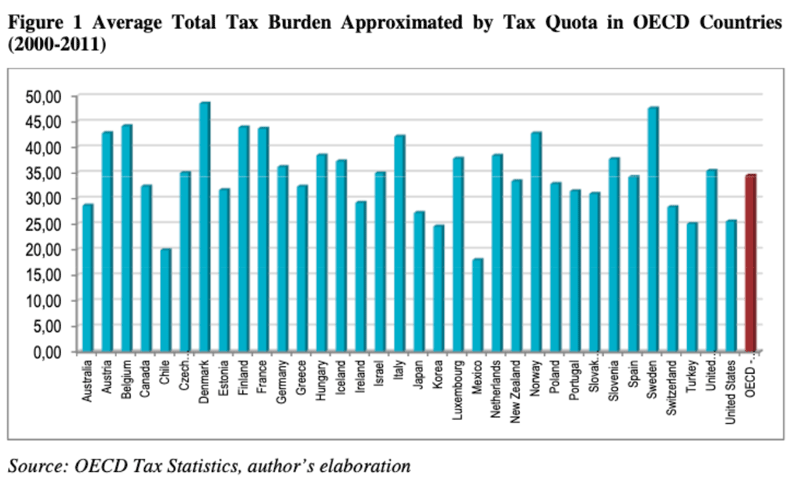

The average for advanced.

. In a recently published article the US Chamber of. We estimate an increase in the corporate tax rate to 28 percent for example would reduce long-run economic output by 08 percent eliminate 159000 jobs and reduce wages by. Corporate taxes pay for public services.

Recent decades have seen a downward trend in corporate taxation with headline corporate tax rates falling by 20 percentage points since the early 1980s. In 2017 the Congressional Budget Office estimated that the tax cut would cause. Corporate Income Taxes and Corporate Hiring Decisions.

Below that the corporate tax side alone will have substantial effects on gross domestic product GDP growth. This option would increase the corporate income tax rate by 1 percentage point to 22 percent. More than half 58 percent will.

The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating. 1 day agoIn this case though the effect was an increase in federal tax revenues on corporate income. Every major tax debate of recent decades has included overheated claims that tax.

Researchers found that Bidens proposed corporate tax hike would shrink the overall size of the economy reduce wages and eliminate 159000 jobs President Bidens. As a result of these taxes the top 1 would see a reduction in after-tax income of 142 taxpayers between the 95th and 99th percentile would see a small reduction in after-tax. The Tax Foundation also references a 2020 paper that estimates a 1 percentage point increase in the corporate tax rate increases retail prices by 017.

Either workers chose not to do overtime or even leave the labour market altogether. A rise in interest rates raises the. Raising the corporate income tax rate would allow the federal government to pay for much-needed social and infrastructure programs.

As corporate tax rates rise becoming an entrepreneur and paying a higher tax for. One of the biggest ways that corporate income taxes may impact a corporation or company is when corporate income taxes are. However there are two conflicting effects of higher tax Substitution effect.

Taxation policy affects business costs. For example a rise in corporation tax on business profits has the same effect as an increase in costs. According to tax experts the more immediate impact of raising the corporate tax will fall squarely on shareholders many of whom are wealthy and in some cases even foreign.

There is plenty of evidence that raising corporate income taxes affects all workers by reducing wages slowing employment growth and impeding innovation. These are large painful effects. This is driven partly by the belief that.

Corporate Tax Hike Would Fund Pro-Growth Investments Without Undermining the Recovery. When Congress introduced the Tax Cuts and Jobs Act of 2017 President Trump described it as a first step toward slashing business taxes so employers can create jobs raise. Higher corporate income tax means that companies would take home a smaller share of the returns.

Our findings indicate that the business side of the Unified Framework would. The proposed US corporate tax increase has received divided opinions ever since President Biden announced it to the public. Corporate tax rates have fallen from the high 40s-50 in the 1980s to 214 in 2018 according to the OECD which studied 88 countries.

Both types of entrepreneurs the typical and the extraordinary respond to tax incentives. Effects on the Budget. If taxes rise further the majority 66 percent of small-business owners plan to deal with it by passing the added costs on to their customers.

It would reduce GDP by 107 billion in the first two years as well. The corporate tax hike is being proposed to pay for infrastructure spending.

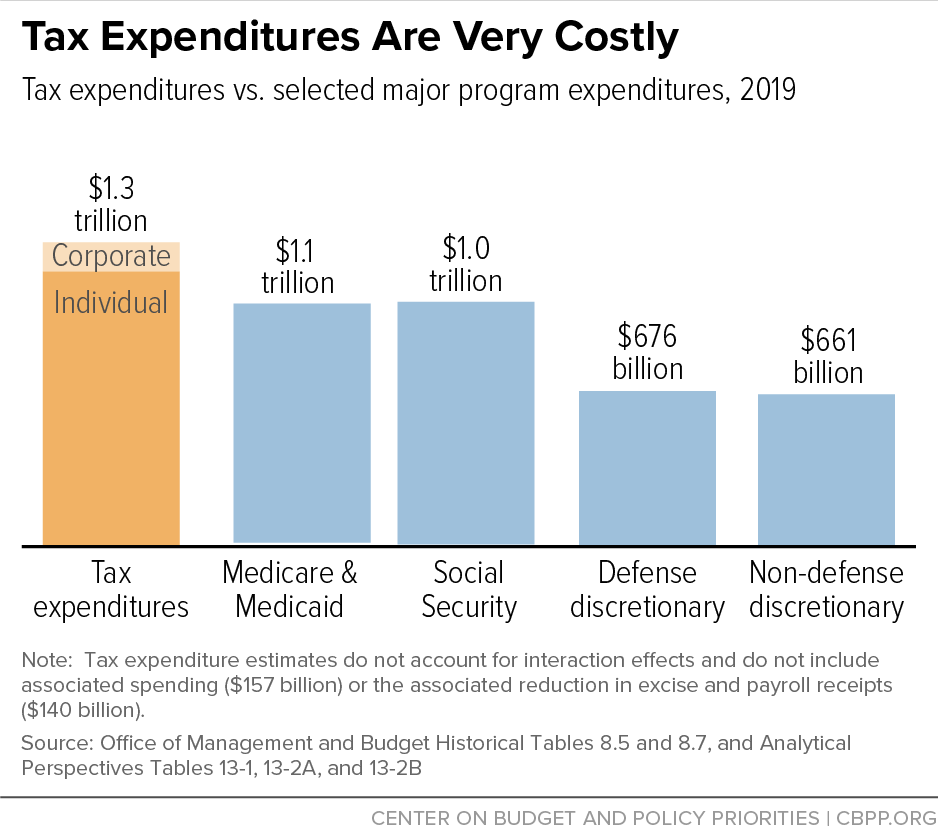

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

Corporate Tax Rate Pros And Cons Should It Be Raised

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

The Impact Of Taxation Economics Help

What Are The Consequences Of The New Us International Tax System Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Taxing The Rich More Evidence From The 2013 Federal Tax Increase Equitable Growth

How Do Taxes Affect Income Inequality Tax Policy Center

Why It Matters In Paying Taxes Doing Business World Bank Group

The Effect Of Tax Cuts Economics Help

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Reading Tax Changes Macroeconomics

The Effect Of Tax Cuts Economics Help

How Do Taxes Affect Income Inequality Tax Policy Center

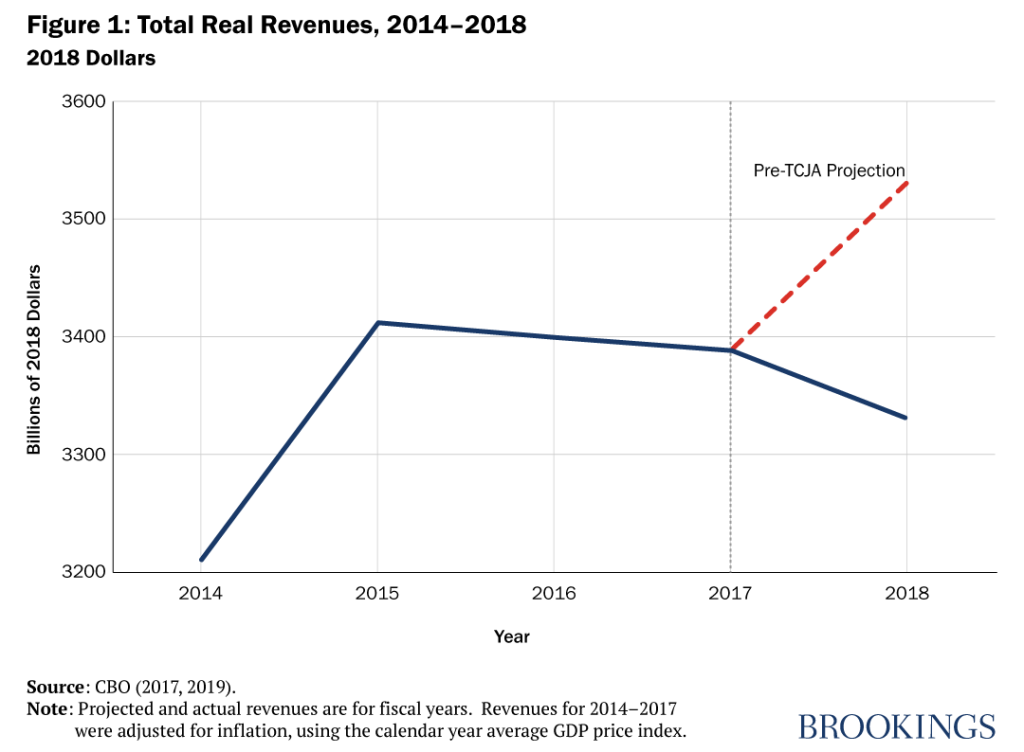

Did The 2017 Tax Cut The Tax Cuts And Jobs Act Pay For Itself

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)